January 2024 Market Summary

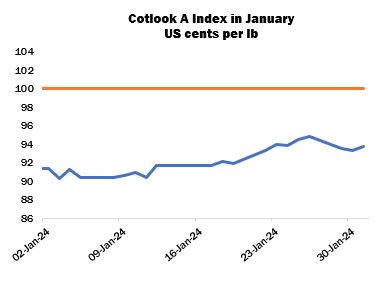

Settlements for the March contract on ICE futures recorded relatively narrow fluctuations in the early part of January, continuing the trend observed in December. Later in the month, however, the contract moved steadily higher in several sessions, as speculators reacted to a tightening US balance sheet for the 2023/24 season. The net gain on the month was 4.17 cents per lb. Turnover was robust. International cotton prices, as measured by the Cotlook A Index, observed a similar trend to end January at 93.7 cents per lb with a net increase of 2.3 cents. The Index high for the month was 94.85 cents (achieved on January 26), a figure not reached since October.

In China, Zhengzhou cotton futures also gained ground: the May contract settled on the first session of January at 15,555 yuan per tonne and ended the month at 16,045 yuan. Trade was characterised by relatively low volume, and open interest during the last week of January was the lowest since July 2022.

Mill buying in the physical market improved somewhat during the first month of the year, despite the rise in offering rates. Pakistan was one of the most active buyers as the domestic crop dwindled. Spinners purchased a wide variety of origins, often recaps or lots discounted on quality considerations. Bangladesh also procured additional volumes, mainly Indian, West African and Brazilian, but a series of problems face mills and manufacturers in the country, including the well-rehearsed difficulties acquiring Letters of Credit, as well as gas shortages, high inflation and interest rates, and the additional costs resulting from shipping disruptions in the Red Sea. A long-awaited uptick of import demand was observed in Turkey during the month in view as local prices increased, while activity was slow in the Far East. For many markets, yarn prices were slow to follow increases of raw cotton costs and spinners’ profitability therefore remained poor.

Mills in China continued to be active buyers of raw cotton for much of January, particularly of consignment stocks of imported cotton. However, buyers retreated somewhat in the approach to the Lunar New Year holiday taking place in early February, as many had by then replenished stocks sufficiently and some had begun to reduce their operations for the break. The country nonetheless featured prominently in the USDA’s 2023/24 export registrations during January, accounting for 47 percent of total new net registrations. Ginning in Xinjiang had reached 5.45 million tonnes by the end of the month, about equivalent to Beijing Cotton Outlook’s estimate of final output.

Meanwhile, the United States Department of Agriculture lowered its domestic current crop forecast by 342,000 bales to 12.43 million bales in January, mainly the result of still greater abandonment in Texas. Exports were reduced from 12.2 to 12.1 million bales, and ending stocks were 200,000 bales lower at 2.9 million. Attention began to turn to planting intentions for the next crop.

Elsewhere in the Northern Hemisphere, harvest activities were also drawing to a close, with the notable exception of India. According to the Cotton Corporation of India, domestic seed cotton arrivals had reached 17.2 million bales by January 31, little more than half of anticipated output. An unanticipated feature of international trading was the emergence of competitively priced export offers from India. Local prices remained fairly stable during January, even when futures rallied during the second half of the month. As a result, from a basis perspective, Indian asking rates enjoyed a competitive advantage in relation to other export origins that followed the movement of New York more closely. Additional export business was concluded in Bangladesh but also in Far Eastern markets including China. On January 19, an Indian quotation was introduced to the selection from which the Cotlook A Index is calculated.

Seed cotton arrivals approached a conclusion in Pakistan. The Cotton Ginners’ Association reported that the figure by January 31 stood at 8.35 million lint equivalent bales, almost equal to private estimates of final output (excluding unreported arrivals). Attention is now turning to prospects for the next crop and the potential for early sowing. Farmers in some of the earliest planted areas had begun field preparations by the end of the month. The late-season firmness of local and international prices may encourage farmers to maintain their cotton area in 2024/25.

Planting neared completion in parts of the Southern Hemisphere during January and developing crops were being monitored. In Brazil, sowing in Mato Grosso was well advanced by the end of the month, and ahead of corresponding figures in recent seasons. Frequent precipitation and sunny spells have benefited young plants in that state as well as in Bahia, leading to a largely favourable outlook for yields. The January official crop forecast of 3.1 million tonnes was therefore regarded as slightly conservative by some observers. Helpful weather was also evident in Argentina, where perhaps more than the 610,000 hectares estimated to be planted to cotton by the Ministry of Agriculture had been sown.

In Australia, where planting was complete before the year-end, Cyclone Kirrily brought heavy rains to some areas of Queensland and smaller amounts to northern New South Wales toward the end of the month. Precipitation since November had boosted water reserves and dryland crop prospects, but many farmers hoped for clearer weather in February. Following the wet spell, local output estimates increased from around four million local weight bales to 4.5/5.0 million bales (1.0/1.14 million tonnes).

Cotlook’s forecast of global raw cotton output in 2023/24 was lowered modestly on the month, to 24.14 million tonnes, as increases for Brazil and smaller producers were offset by a reduction for the United States. Our global consumption estimates were meanwhile left unchanged in January. Therefore, the anticipated surplus of world stocks for the current season has narrowed marginally to 539,000 tonnes.