July 2023 Market Summary

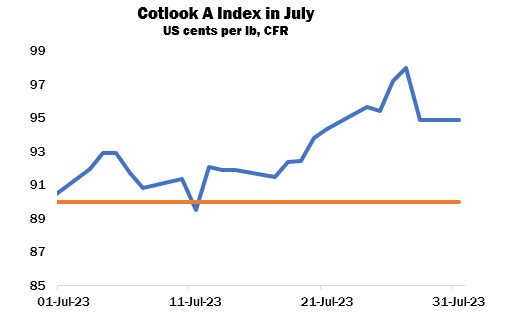

July witnessed a strong rally in world prices under the lead of New York futures. On June 28, the Cotlook A Index had fallen to 88.70 cents per lb, which proved to be its low point of the 2022/23 season. In early July, the A Index again dipped below 90.00 cents per lb – considered the threshold beneath which many spinners of medium count yarns might hope to generate positive margins, or at least break even. However, the weakness proved short lived and the market was quickly propelled upward by a period of speculative buying in New York.

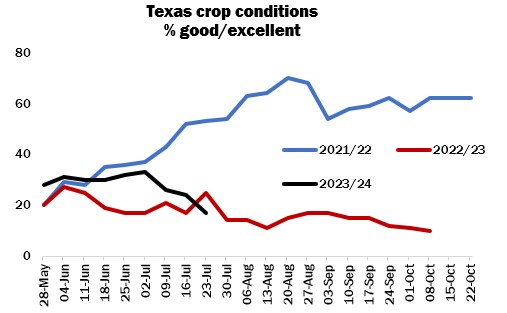

Amongst the factors influencing the behaviour of investors in New York were the more sanguine expectations with regard to the United States economy. The Dow Jones performed well during July and even the Federal Reserve’s latest 0.25 percentage point hike in interest rates failed to dampen the mood. From a cotton perspective, the weather in West Texas took another turn for the worse with the arrival of exceptionally hot temperatures that promise to take a toll on dryland cotton in the region. By July 30, the proportion of cotton rated ‘Good to Excellent’ had fallen to 17 percent, well below the five-year average and even lower than the figure at the same point of the 2022/23 season. USDA’s July production forecast was maintained at 16.5 million bales (480 lbs) but the expectation was that the number would be reduced in August.

Higher prices did run counter to the still very poor state of global mill demand. For months now, the world cotton textile market has been suffering the effects of global economic slowdown. Inflation, rising interest rates and a general lack of consumer and business confidence have combined to undermine demand from the retail end of the supply chain back to the spinning mill.

The only active import market of late has been China, and that remained the case throughout July. The recent realignment of Chinese and international prices restored the relationship between the two to a more customary position and thereby provided an incentive for Chinse buyers to turn to the international market. However, the bulk of buying interest was attributed to state and private trading houses rather than to mills. Although unburdened by inflation or high financial costs, Chinese spinners were not unaffected by the economic headwinds that undermined the profitability of their counterparts elsewhere in the world.

The bullish mood of the Chinese market nonetheless persisted throughout the month, with Zhengzhou cotton futures reaching new highs. The September contract recorded a settlement of 17,225 yuan per tonne on July 21, an increase of almost 20 percent since the turn of the year. The principal drivers of the rising trend were concerns with regard to the supply side of the domestic market. Commercial or free market stocks (those held outside the State Reserve) were projected to tighten significantly prior to the movement of the domestic 2023/24 crop. The likely size of that crop was meanwhile open to question. The area sown to cotton this spring is calculated to have declined by around nine percent as farmers reacted to the poorer returns obtained during the 2022/23 season. For those in Xinjiang, official indications that the volume eligible for subsidy would be capped may also have been influential.

Yields were also considered to be in some doubt. Cool weather was unhelpful during the planting period. Thereafter, plants were subjected to extreme temperatures akin to those experienced in West Texas.

Late in July, the government reacted to the uncertain supply situation and the rising local market with two policy initiatives, each intended to assure continuity of supply to the local spinning industry and to impart some stability to the domestic cotton market.

First, it was announced that a State Reserve auction programme would commence before the end of the month. A few days later, the market was informed that a discretionary import quota in the amount of 750,000 tonnes would be established. In both cases, participation was to be confined to spinners.

The first sales auction took place on July 31 and attracted a brisk participation. All 10,000 tonnes on offer found buyers at firm prices.

Crops in the Northern Hemisphere experienced contrasting fortunes during July. As already indicated, excessive temperatures in parts of the United States and China placed yield potential in both countries in doubt. Cotton on the Indian subcontinent fared better. In Pakistan, the prevailing hot, dry conditions were punctuated by periods of rain that were not thus far considered excessive. Rainfall was well distributed across most of India’s cotton areas, which allowed planting to make up for a slow start.

At the end of July, Cotton Outlook’s forecast of world production in 2023/24 stood at 25,942,000 tonnes, a modest increase of 12,000 on the month. An increase in the projection for Brazil was only partially offset by a reduction for China. The estimate of consumption during the season ahead was unchanged at 24,253,000 tonnes, suggesting a further substantial addition to world stocks by the end of July, 2024.