December 2023 Market Summary

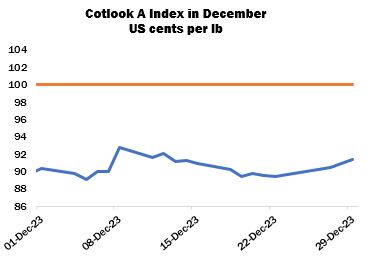

During December, settlements for the March contract on New York futures fell within a narrow range of 78.68 to 82.59 cents per lb. World prices followed a similar pattern: the Cotlook A Index started the month at 90.3 cents per lb, and ended at 91.4 cents. Much like the rest of the year, a lack of obvious direction or volatility characterised the market during the last month of 2023.

Meanwhile, China’s Zhengzhou cotton futures traded within a lower range than in November: the lowest close was 14,905 yuan per tonne, reached on December 4, and the high was 15,550 yuan at the end of the month.

In the physical market, poor downstream demand continued to dampen trade during December. In Bangladesh, issues acquiring Letters of Credit continued to plague spinners and their suppliers, whilst unrest in response to garment workers’ pay and in the run-up to the general election led to many approaching new business with extra caution. Pakistan also continued to experience LC problems, but a modest level of import business was observed as local supplies dwindled. Particularly in demand were Brazilian, US, Tanzanian and Afghan supplies, often discounted lots or recaps available afloat or for prompt shipment. Overall, mostly hand-to-mouth buying persisted and price ideas were difficult to reconcile for many.

International trade was also affected by shipping delays as attacks on vessels in the Red Sea prompted many freight lines to reroute ships – adding significant delays and costs that will only further strain the generally poor returns obtainable for cotton and yarn.

Buyers in China, however, were slightly more active in the world market during December, perhaps encouraged by the wider spread between Zhengzhou and New York futures. Spinners also continued to purchase from stocks held on consignment at ports, as well as from the domestic crop, the ginning of which was almost complete by the end of the year. The USDA revealed that during December, the country accounted for 388,400 running bales (or 55 percent) of the 705,500 new 2023/24 upland export registrations. The largest weekly volume recorded during the month, 369,900 bales in the week to December 21, included 271,200 bales (73 percent) for China. According to Chinese trade data, raw cotton imports in November totalled 310,000 tonnes, the largest monthly volume recorded since January 2021.

In the United States, harvesting approached a conclusion across the cotton belt, and ginning slowed. The December estimates published by the Department of Agriculture saw the forecast of domestic output in 2023/24 reduced to 12.78 million bales, predominantly due to a 500,000-bale decrease in Texas (attributed to poor yields of just 419 lbs per hectare) that was only partially offset by increases in other states. Mill use and ending stocks were also lowered – to 1.9 and 3.1 million bales, respectively.

Harvest activities also neared completion in many other Northern Hemisphere countries. The Cotton Corporation of India placed domestic arrivals by January 1 at 10.89 million lint equivalent bales, while arrivals in Pakistan had passed 8.17 million bales by December 31, according to the Pakistan Cotton Ginners’ Association. Deliveries in Sindh and Punjab were almost equal, despite a historical production bias for the latter. Private estimates of the final crop (excluding unreported arrivals) have converged at around 8.5 million bales.

In the Southern Hemisphere, meanwhile, planting accelerated. In Argentina, sowing expanded significantly and welcome rainfall was received in some areas, which may encourage late planting. By December 28, 77 percent of the Ministry of Agriculture’s revised planting intentions figure of 610,000 hectares had been sown. Planting was complete in Australia and some plants had started to flower. Rainfall had replenished water stores to the benefit of dryland fields, though flash flooding caused damage to infrastructure in coastal areas of Queensland and New South Wales late in the month. Ginning of the 2023 crop in Brazil was virtually complete by the end of December, and the positive outlook for the 2024 crop was sustained. Planting was in its early stages in Mato Grosso but was further advanced in Bahia. Despite ongoing logistical difficulties, 350,792 tonnes of raw cotton were exported by the country during the month in view, the second highest monthly volume ever recorded in Brazil.

Cotton Outlook’s December supply and demand review included an upward adjustment of 75,000 tonnes for 2023/24 global production as the results of Northern Hemisphere crops became clearer. The increases, attributed to China, the African Franc Zone and Uzbekistan, were partially offset by lower figures for the United States and smaller producers. Our forecast of world consumption for the season was lowered by 296,000 tonnes, owing to adjustments predominantly for China and the United States. The figure now represents only a marginal improvement from 2022/23, and the margin by which output is expected to exceed consumption has widened to 559,000 tonnes.